More and more of Colorado’s energy grid is supplied using renewables like solar panels and wind turbines. So, switching from natural gas to electric heat pump water heaters and whole house heating systems will help reduce greenhouse gas emissions. Fortunately, Colorado residents can get heat pump rebates and tax credits to pay for cost-effective heat pump systems. Heating and cooling equipment are the largest energy consumers in a typical home. So, upgrading gets you tax credits and rebates while saving you money every month!

Homeowners can utilize federal and local incentives to invest in high-efficiency upgrades. For example, the Inflation Reduction Act provides all homeowners with a $2,000 heat pump tax credit for whole house heating systems and an additional $1,750 tax credit for heat pump water heaters! In addition, Mountain View Electric offers up to $2,400 in credits, and Colorado Springs Utilities offers up to $1,000 in credits!

Table of Contents

Is a new hot water heater tax deductible in 2023?

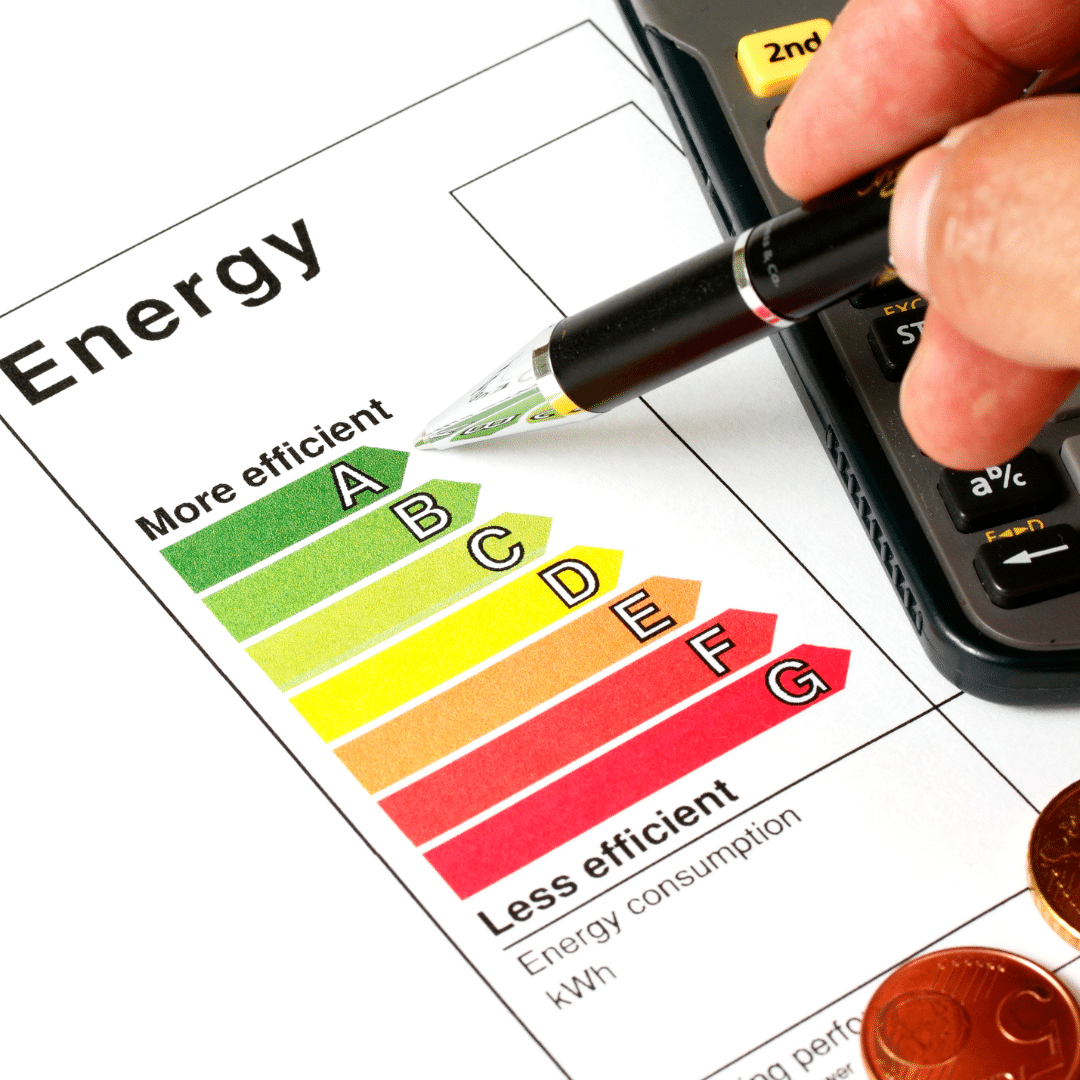

The Inflation Reduction Act provides tax credits for ENERGY STAR water heaters in 2023. However, “tax credit” doesn’t mean the same as “tax deductible.” A heat pump tax credit lets you reduce the amount of taxes owed. Whereas, a deduction would lower your taxable income.

What Are Heat Pump Tax Credits For?

Federal and state governments offer tax credits as an incentive to purchase energy-efficient home appliances. For example, the Inflation Reduction Act provides homeowners and builders with new rebates and tax credits specifically targeting home improvements that help owners consume less energy and lower their utility bills.

How do Federal Tax Credits work?

The federal government has allocated over $140 million to Colorado for clean energy rebates. From there, the Colorado Energy Office administers these tax credits. For example, anyone who buys an ENERGY STAR new water heater in 2023 can claim a tax credit of $2,000 or 30% of the cost, whichever is lower. There is also a cap of $3,200 for your total energy efficiency tax credits in one year. So, keep that in mind if you are making multiple home appliance upgrades.

Colorado State Tax Incentives

Last year, the Colorado General Assembly passed Senate Bill 51, called “Policies to Reduce Emissions From Built Environment.” The bill offers several heat pump tax credits and incentives. For example, all heat pump systems are exempt from sales tax under the new law. In addition, anyone who installs a heat pump system in the state is eligible for an income tax credit equal to 10% of the purchase price. Plus, these incentives stack, meaning you get credit on both your state and federal tax returns.

Water Heater Heat Pump Rebates

Utility companies and electric co-ops also offer rebates to encourage homeowners to purchase energy-efficient appliances. Eligibility depends on where you live and who is your electricity provider. For example, Colorado Springs Utilities gives customers a $200 rebate to their customers and Mountain View Electric gives $350 plus an additional $50 for switching from a gas water heater to electric.

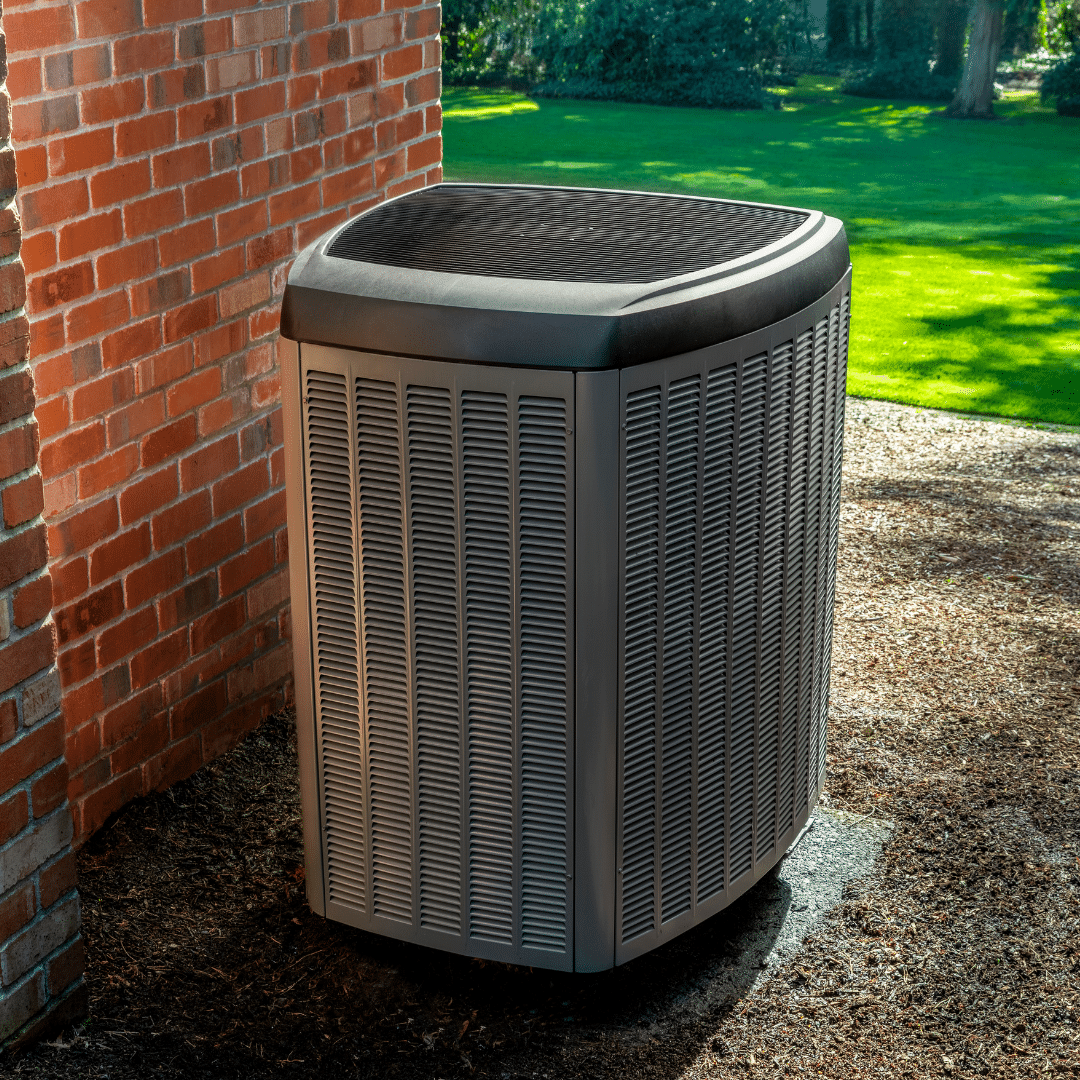

Space Heating and Cooling Heat Pump Rebates

Local electric associations are moving away from fossil fuels and toward low-cost renewables, so electricity is becoming cheaper and more eco-friendly. That’s why they encourage members to electrify and save by offering heat pump rebates. For example, Polar Bear Mechanical heat pumps all qualify for the $2,000 federal tax credit as well as the Mountain View Electric Rebate for $2,400. Since the heat pump is also a high-efficiency Air Conditioner it also qualifies for an additional $100 for a high-efficiency AC, and their touch screen programmable thermostat gets you another $25. Colorado Springs Utilities’ customers get the same $2,000 tax credit plus $500 for the cost-effective heat pump, and $50 for the thermostat.

Black Hills Energy

Black Hills Energy offers a $500 rebate to purchase and install ENERGY STAR heat pump water heaters to encourage energy savings. They also provide virtual home energy assessments and free home energy kits to help customers save on electricity.

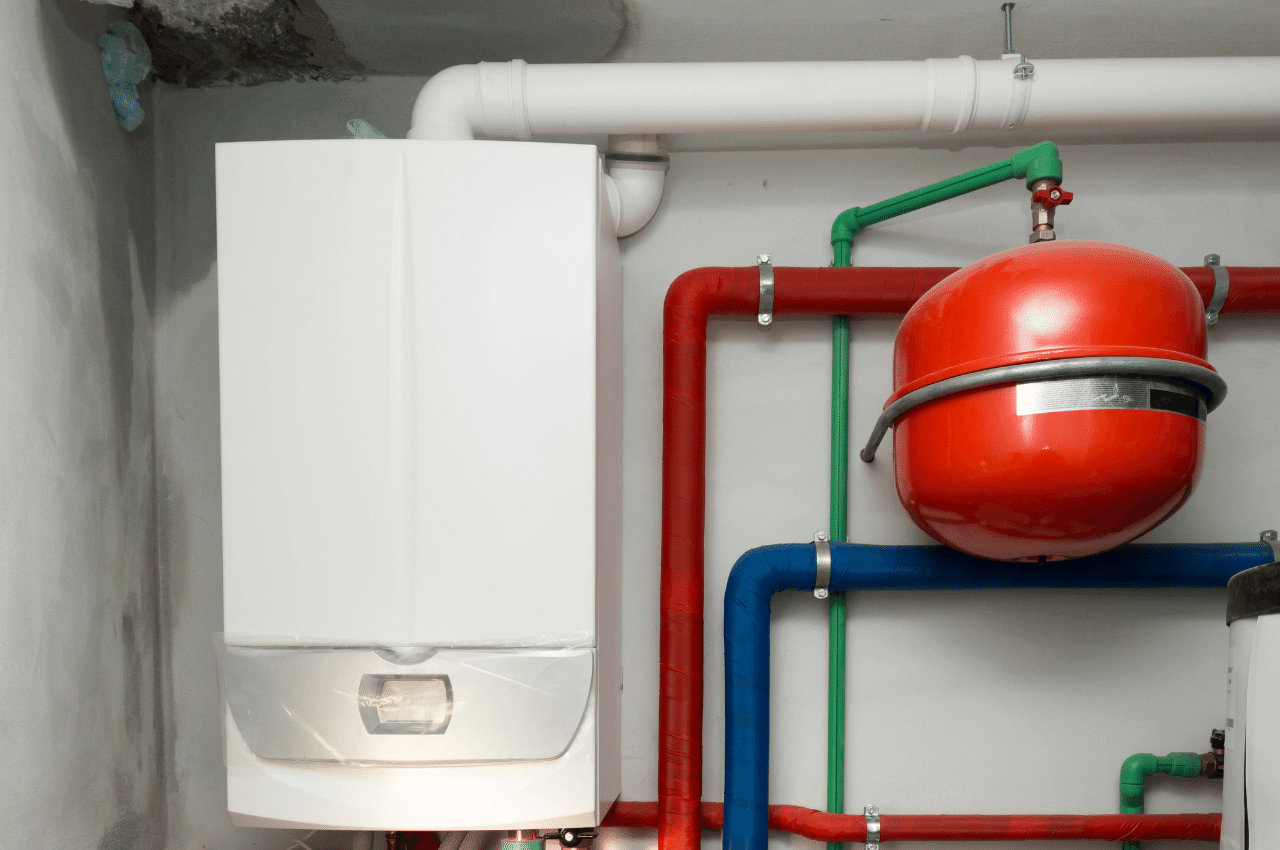

Colorado Water Heater Heat Pump Installation

At Polar Bear Furnace and AC, we are fed up with seeing El Paso County homeowners burning money on expensive propane to heat their homes! Not only can it be expensive to buy and maintain, but it can also be inefficient, leading to higher heating bills and uncomfortable temperatures. We hate to see people burning money on expensive propane and sacrificing their comfort in an effort to reduce heating costs. That’s why we are the Propane Mavericks and specialize in heat pumps as an alternative to propane heating solutions. Heat pumps provide effective heating, while also being more energy efficient and cost-effective than propane. We love to see our customers save money with cost-effective heat pumps and stay warm and comfortable in their homes. Our team is committed to delivering exceptional customer service and the highest quality heating solutions that help homeowners save energy and stay comfortable in their homes- and we won’t stand for any less! Let us help you save money and stay warm this season! Give us a call or text us at 719-329-4304 for more information, or request a free in-home heat pump consultation online today. At Polar Bear, we care!